Lobby register: more informational value and transparency for citizens

Today, the ACA submitted the following reports:

- Register for Lobbying and Interest Representation

- Financial Flows Between Provinces and Municipalities as Exemplified by Ansfelden in Upper Austria and Feldkirchen in Carinthia

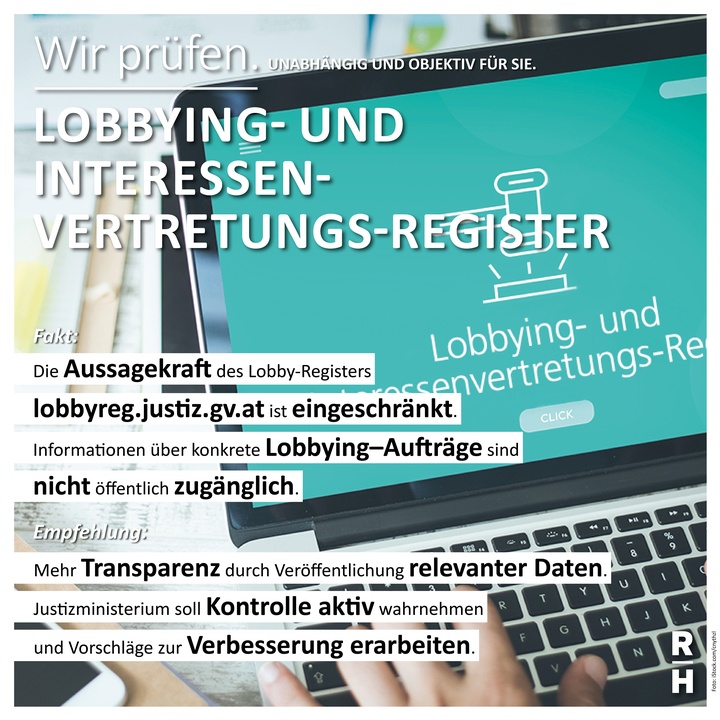

The aim of the Lobbying and Interest Representation Transparency Act (Lobbying- und Interessenvertretungstransparenz-Gesetz, abbr.: LobbyG), which entered into force on 1 January 2013, was to create clarity with regard to which kind of activities have an influence on the formation of laws. However, the Register for Lobbying and Interest Representation (lobby register), which was established by the LobbyG and which is available online at lobbyreg.justiz.gv.at, does not contribute effectively to increasing transparency. Furthermore, the legal situation in Austria does not live up to the international standards. This is revealed in the report published by the ACA entitled “Register for Lobbying and Interest Representation”. The audit covered the years from 2013 through 2018.

Little informational value

The lobby register does not provide an overall overview and the data published therein largely lack informational value. The information provided on the activities of the lobbyists, for example, does not contain any indications on the concrete area of lobbying (e.g. healthcare). In most of the cases, the subject matter did not indicate which law was to be influenced, although the explanatory notes of the LobbyG suggested such an indication. Only in nine of overall 364 entries such information was provided. These data, however, were not publicly available, and neither was information on concrete lobbying mandates. The citizens are therefore denied substantial information.

More transparency for citizens

The ACA therefore recommends to the Federal Ministry of Constitutional Affairs, Reforms, Deregulation and Justice to evaluate the LobbyG. Furthermore, it should be assessed whether international standards on lobbying could be integrated more comprehensively. A corresponding bill should be elaborated. In the interest of creating an added-value for the citizens, the possibilities for inspecting the lobby register should enable the public to have increased access to relevant data.

Ministry of Justice was not active enough

At the time of the audit, the ministry only saw the need for running the register. The ACA criticizes this opinion since the ministry did not feel responsible for examining the informational value of the entries or to assess whether the obligation to register was fulfilled.

The ACA recommends to elaborate suggestions with regard to how the ministry could assume its tasks in its capacity of an effective and proactive control body according to the international recommendations and, subsequently, to consistently report violations of the LobbyG.

- pdf Datei:

- 2,898.8 KB

- Umfang:

- 90 Seiten

Report: Register for Lobbying and Interest Representation

From June to August 2018, the Austrian Court of Audit carried out an audit of the Register for Lobbying and Interest Representation. It compared the legal foundations with international standards and assessed the implementation of the register, in particular the costs, the completeness and the correctness of the entries, the value added for citizens as regards queries and the attainment of objectives. The audited period spanned the years from 2013 through 2018.

- pdf Datei:

- 2,857.6 KB

- Umfang:

- 92 Seiten

Report: Financial Flows Between Provinces and Municipalities as Exemplified by Ansfelden in Upper Austria and Feldkirchen in Carinthia

From April to August 2018, the Austrian Court of Audit (ACA) carried out an audit of the financial flows between the provinces and the municipalities as exemplified by the province of Carinthia and the municipality of Feldkirchen and the province of Upper Austria and the municipality of Ansfelden. The audit focused on the identification of the existing financial flows, the distributive and incentive effects of the most important financial flows and the informational value of the accounting system of the provinces and the exemplary municipalities with regard to such financial flows. The audited period covered the period of 2016 to 2017. As the Financial Equalisation Act 2017 (Finanzausgleichsgesetz 2017) introduced numerous amendments, the ACA assessed the current legal situation and focused on 2017.

Central recommendations

- Unless different distributive effects are intended explicitly, a uniform definition of financial strength should be employed in the municipalities as regards the calculation of levies and ad-hoc grants in order to increase transparency, mitigate the risk of error and improve budget pre-dictability.

- Based on an analysis of the current distribution of financial funds of the municipalities and in taking into account all financial flows, a general distributive goal should be defined, which should be considered in particular for the awarding of ad-hoc grants.

- The only parameters taken into consideration for the determination of the levies and contributions of the municipalities were their financial capacity and the number of inhabitants. The use of services that could be allocated to the individual municipalities was not considered. The calculations of the contributions, in particular of those paid to cover the losses of the hospitals and for social welfare, should be based on expenses attributable to the individual municipalities in order to facilitate the matching of expenditure responsibility and financing.

- The financial equalization between municipalities should be separated from the determination of the contributions and be implemented separately based on a regional political strategy. In the framework of future negotiations related to financial equalization, this should be taken into account for the distribution of revenue shares.